The management and monitoring of investment are also improving. These are some of the factors that make the Forex market to be more attractive than many other markets globally. The huge turnover in the Forex market is one of the more reasons it becomes attractive to so many investors. So long as you know about trading, you can go into it to make money. The Forex market offers so many advantages that you can rarely find in many other markets across the globe. Canada is amongst the few advanced nations globally that allow its residents to invest their funds with unregulated foreign Forex brokers when we talk about trading in Canada.

- If the USD/CAD exchange rate increases to 1.25, then the base currency will have increased in value.

- Many brokers only charge the spread; others also charge commissions per order.

- In second place on my list of best forex trading platforms in Canada is Interactive Brokers.

- These charting and technical tools will equally be very easy to use.

- Make sure the location offers marketing research curves, the power to ascertain live odds and costs .

When you use high leverage, you can make a huge profit with small capital. This is because leverage makes it possible for you to trade higher volumes with your small capital. It is possible to make a lot of money from Forex trading by using leverage. Be that as it may, you must also understand the dangers involved. It can help you to make a lot of profit and can also cause you losses.

What is forex trading?

Mini account holders can place trades with a minimum of one mini lot size. This means that a mini lot is a tenth fraction of a standard lot. That is why we constantly update our ratings to ensure Canadian traders are getting the latest information on the foreign exchange market. This can normally be done via bank transfer or sometimes with a bank card and once your money has been credited to your account you can start trading. The Commission has been made aware of a Manitoba resident who has received a cold call from a purported Forex dealer located in Costa Rica soliciting an investment.

What Is Forex Trading and How Does It Work? – Money

What Is Forex Trading and How Does It Work?.

Posted: Tue, 23 May 2023 07:00:00 GMT [source]

The settlement occurs for cash when they expire at the exchange under consideration. The futures and forwards markets can protect the trader from risks during currency trading. Big corporations of international standings make use of the futures and forwards markets for hedging against future fluctuation in the exchange rate.

Forex Trading – What to Know Before Getting Started

There is a regular change in the values of the currency pairs and this creates opportunities to make a profit. The currencies above are currencies from those countries that are financially powerful across the globe. The high trading volumes of each of the currencies make them highly volatile and also help to reduce the spread. The number of traders that are trading a particular currency pair at a particular time can determine the behavior of the currency pair. There are so many currency pairs available in the Forex market. The currency pairs you can access depend on what your broker offers.

We have listed a good choice of forex official websites below to help you get started. The best Forex broker for beginners are companies that have extensive training tutorials, guides and demo accounts available for new members. You should therefore research and compare the tools available by the top Forex brokers as some are only suitable for experienced day traders. However, before you can start trading you will have to verify your account. The Forex broker will then review your documents and verify your account within a couple of days. Using the USD/CAD currency pair as an example, the currency on the left is known as the base currency while the currency on the right is the quote currency.

High Leverage Forex Brokers Canada

There should be no problems when making a deposit and the withdrawal process must also be without hitch. A good broker will never make any of these processes to be difficult. Any broker that makes the process to be difficult is bad. The only reason why a broker holds your fund is to enable you to trade Forex. You should have complete freedom to your funds any time you want to withdraw it.

One of the best ways to know if a broker is credible is by checking its regulation status. The regulatory agencies will help you to know if a broker is fraudulent or trustworthy. Many of the untrustworthy, fraudulent ones are not regulated. You should also find out if the regulation is by a tier-1 regulatory agency. When choosing a broker in Canada, look for one that is regulated by the Investment Information Regulatory Organization of Canada (IIROC). Such a broker will not be fraudulent and your money will always be safe there.

Why is the bullish market important?

A good forex broker provides clients with many educational tools. These tools help traders to learn more about forex trading in Canada and make informed decisions. When you want to venture into online trading as a beginner, you need all the important educational material.

- They do this by fixing the rate at which the completion of the transaction occurs.

- These brokers offer forex webinars for beginners as well as good customer service with low cost.

- These individuals can make a profit by trading via brokers or banks.

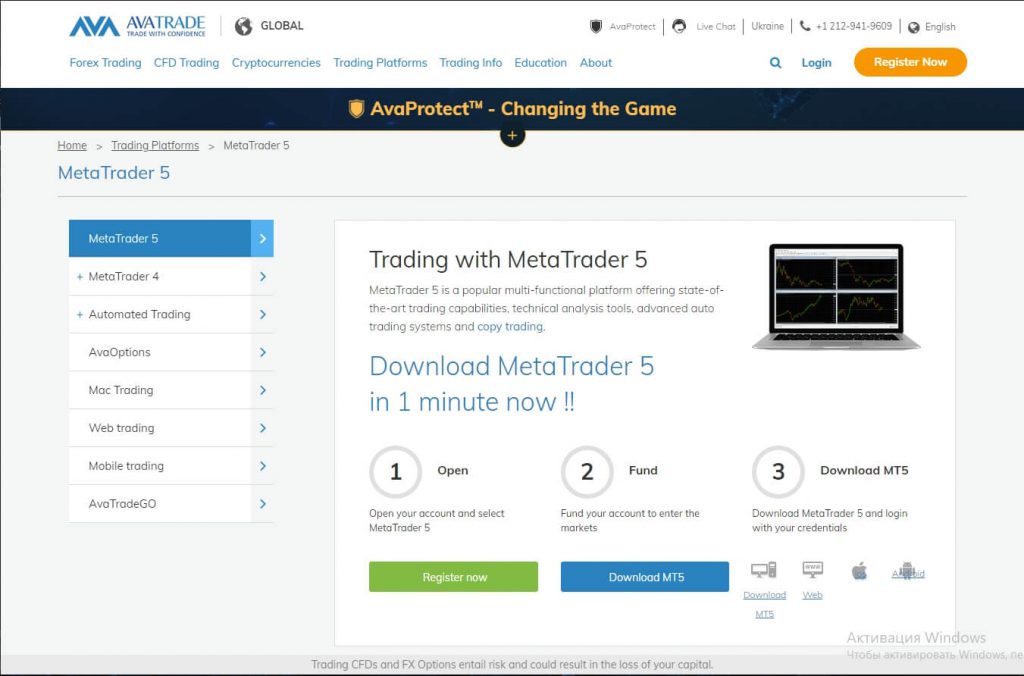

- The most common of all forex trading platforms is the MetaTrader 4 (MT4) trading platform.

- This is because Forex trading required a huge capital in those days.

- A country’s underlying economic performance can affect the price of its dollar.

They offer equities, ETFs, mutual funds, options, GICs, bonds, and IPOs. Scotia iTRADE’s commissions are similar to other bank brokerages, with their stock commission being $9.99 per trade and options at $9.99 plus $1.25 per contract. You’ll also get free access to level 2 quotes for TSX securities. For equities, Scotia iTRADE only offers stocks listed in Canada or the U.S. RBC Direct Investing is an online investing service offered by Royal Bank of Canada (RBC).

What is the leverage in Forex trading for beginners?

However, the regulatory agency in Canada curtails this activity. This is because it is not in the best interest of the forex trader that registers with that broker. We already discussed this above, but we will mention it again for the sake of emphasis. Some brokers charge additional fees from trading activities. As a result of this, many brokers charge low fees so that they can attract more customers.

The two parties determine the agreement terms between the two of them. The futures market has to do with the buying and selling of futures contracts. https://forex-reviews.org/ It has its basis on public commodities markets and standard size. Examples of public commodities markets include the Chicago Mercantile Exchange.

The regulation of the Futures market in Canada is the duty of the ICE Futures Canada. Canada is remarkable in that it is separated into many domains based on states and territories. Each state has its regulatory agency that can impose additional restrictions not covered by the IIROC. Citizens of Alberta, for example, must fulfill other requirements, such as their net worth and degree of trading expertise, before they may create a Forex trading account. Many of the local legislation levels have lately been harmonized, making it more uniform across the country. Keep your trading costs down with competitive spreads, commissions and low margins.

You should not register with that broker if it is not a member of the IIROC. You will never regret it since this body will help to protect your interest with the broker. To learn more about Interactive Brokers as an overall brokerage, make sure to read my Interactive Brokers review. Our License Checker verifies the validity of EU, UK and UAE broker licenses in near real-time. They also have strong oversight, and swift enforcement of sanctions on fraudulent brokers.

The particular lot size you choose will determine how much profit you can make per trade. In the Forex market, both the bear and the bull trends can tell the one that is stronger between two currencies. The trader needs to first understand the trend before making a trade. A proper understanding of the trend will help the trader to make the right choice when trading. He will be able to make up his mind about when it is the best time to enter or exit a trade.