Securities do not include financial items that are backed by other assets. Debts that are secured by an account receivable are also not considered securities. No investment strategy can guarantee a profit or protect against loss. All investing carries some risk, including loss of principal invested. Certificated securities are those represented in physical, paper form. Securities may also be held in the direct registration system, which records shares of stock in book-entry form.

Other examples include certain variable-income securities, such as floating rate notes and variable rate demand obligations as well as government Treasury bills and Treasury notes. Preference shares form an intermediate class of security between equities and debt. If the issuer is liquidated, preference shareholders have the right to receive interest or a return of capital prior to ordinary shareholders. However, from a legal perspective, preference shares are capital stocks and therefore may entitle the holders to some degree of control depending on whether they carry voting rights. Government bonds are medium or long term debt securities issued by sovereign governments or their agencies.

Example 4. Exchange-Traded Funds (ETFs)

When saving for retirement, most people choose to put a portion of their savings in equity or debt securities. These securities markets are also important for the market as a whole, in that they allow companies https://topforexnews.org/news/get-the-tunnel-trading-course/ to raise capital from the public. In contrast, if a publicly traded company takes measures to reduce the total number of its outstanding shares, the company is said to have consolidated them.

Shareholders retain a portion of the company they invest in, and stock represents their ownership rights. The company can use shareholder equity to fund operations and expansion. In exchange, the shareholder receives voting https://currency-trading.org/software-development/professional-solutions-architect-job-description/ rights and periodic dividends determined by the profitability of the business. Stock exchanges list publicly-traded securities, which give issuers a chance to seek investors by ensuring a regulated and liquid market.

Who Regulates Securities?

The U.S. Securities and Exchange Commission oversees the sale and trade of securities with the help of Self-Regulatory Organizations (SROs). Those groups include he National Association of Securities Dealers (NASD) and the Financial Industry Regulatory Authority (FINRA). There were nearly 3,400 reported public offerings in 2020 at a median size of $360 million and an average amount raised of $550 million. Access to capital is particularly critical for small businesses to grow and scale. Learn more about what we do to facilitate ways to raise capital by visiting our small business information site as well as our Office of the Advocate for Small Business Capital Formation.

For institutional loans, property rights are not transferred but nevertheless enable A to satisfy its claims in case B fails to make good on its obligations to A or otherwise becomes insolvent. Collateral arrangements are divided into two broad categories, namely security interests and outright collateral transfers. Commonly, commercial banks, investment banks, government agencies and other institutional https://day-trading.info/network-security-specialist-freelance-jobs/ investors such as mutual funds are significant collateral takers as well as providers. In addition, private parties may utilize stocks or other securities as collateral for portfolio loans in securities lending scenarios. Hybrid securities combine the characteristics of both equity and debt securities. They are corporate bonds that investors can convert into shares of the issuing company’s stock.

Bonds

With a broad array of integrated solutions that span investment strategies, fund structures, asset types and geographies, J.P. Morgan Securities Services delivers the expertise, scale and capabilities to help our clients protect and grow their assets, optimize efficiency and maximize opportunities in diverse, global markets. The Uniform Transfers to Minors Act (UTMA) account is another type of custodial account. It allows investments into other types of assets, including real estate and intellectual property. When you buy a bond, you’re lending money to a company, government entity, or municipality.

FCA fines Bastion Capital for cum-ex violations – Securities Finance Times

FCA fines Bastion Capital for cum-ex violations.

Posted: Thu, 13 Jul 2023 14:22:46 GMT [source]

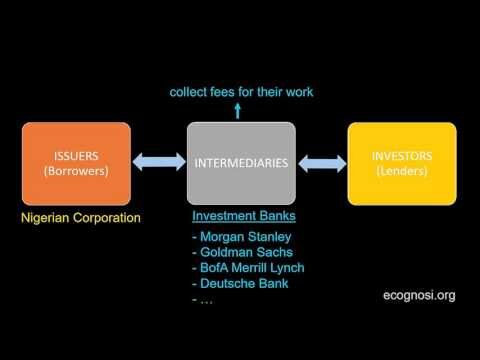

Debt securities are financial assets that define the terms of a loan between an issuer (the borrower) and an investor (the lender). The terms of a debt security typically include the principal amount to be returned upon maturity of the loan, interest rate payments, and the maturity date or renewal date. Debt securities may be called debentures, bonds, deposits, notes or commercial paper depending on their maturity, collateral and other characteristics. The holder of a debt security is typically entitled to the payment of principal and interest, together with other contractual rights under the terms of the issue, such as the right to receive certain information. Debt securities are generally issued for a fixed term and redeemable by the issuer at the end of that term. Debt securities may be protected by collateral or may be unsecured, and, if they are unsecured, may be contractually “senior” to other unsecured debt meaning their holders would have a priority in a bankruptcy of the issuer.

PROTECTING INVESTORS

Ownership of securities in this fashion is called beneficial ownership. Each intermediary holds on behalf of someone beneath him in the chain. Equity warrants are options issued by the company that allow the holder of the warrant to purchase a specific number of shares at a specified price within a specified time. They are often issued together with bonds or existing equities, and are, sometimes, detachable from them and separately tradeable.

- Convertibles are bonds or preferred stocks that can be converted, at the election of the holder of the convertibles, into the ordinary shares of the issuing company.

- Examples of SROs include the National Association of Securities Dealers (NASD), and the Financial Industry Regulatory Authority (FINRA).

- Private securities may also be traded among qualified investors, but is less liquid for privately placed securities.

- We customize a lending profile for you, including a tailored strategy based on your requirements, stated objectives and risk tolerance.

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. Generally, if an investment of money is made in a business with the expectation of a profit to come through the efforts of someone other than the investor, it is considered a security. Although crypto assets haven’t been cleanly defined or regulated, the SEC is working toward doing just that. For now, it’s best to assume that crypto assets are unregulated and not treated as financial securities until you know for sure.